open ended investment company taxation

The federal securities laws categorize investment companies into three basic types. So if you buy newly issued shares for example in a VCT there is no stamp.

What Is A Global Minimum Coporate Tax And How Would It Work World Economic Forum

Meaning of open-ended investment company - section 613 Corporation Tax Act 2010.

/london_stock_exchange-113017429-d2af52b2c72b427e8043a62cb5e01778-0b36a05ede834f7b84942c9b1b2c8bee.jpg)

. NOTRE DAME LAWYER 1246-48 affords similar treatment to foreign investment companies registered with the Securities and Exchange Commission. The direct tax treatment of OEICs is established by the Authorised Investment. 60 which are incorporated in the United Kingdom.

They form part of many client investment portfolios and advisers need a thorough understanding of how they are taxed both on distributions and on disposals. This means investors pay taxes on any capital gains or income derived. Amalgamation of an authorised unit trust with an open-ended investment company.

1 The Trust is organized as a Massachusetts business trust and is registered as an open end management investment company under the Investment Company Act of 1940 as amended 15 USC 80a-1 et seq. Capital gains are exempt from tax at fund level and instead CGT is levied at client level on disposals. An open-end investment company makes a continuous offering of its shares that are redeemable.

In other words an open-end investment company issues new. Closed-End Investment Companies A closed-end company makes a one-time offering of its. This practice note provides an overview of the tax issues that arise in respect of UK authorised and unauthorised unit trusts and UK open-ended.

Open-End Investment Company Primarily in the United Kingdom a mutual fund in which the number of shares may be increased or decreased depending on the amount of money invested in the company. OEICsUTs are only subject to tax within the fund on income received by the fund manager. The Company is however subject to a subscription tax taxe dabonnement levied at the rate of 005 per annum based on its net asset value at the end of the relevant quarter calculated and paid quarterly.

LTTA7090 Relief from land transaction tax. 1939 Code supplement Q and in the 1954 Code subchapter M it benefited only open-end companies not closed-end companies. An open-end investment company is the technical term for a mutual fund.

By Anthony Stewart Laura Underhill and Violet Marcel Clifford Chance LLP tax group and Simon Crown Clifford Chance LLP regulatory group. The taxation of open-ended investment companies An outline of the main tax considerations for open-ended investment companies and investors in the UK. No stamp duty capital duty or other tax will be payable in Luxembourg upon the issue of the shares of the Company.

Stamp duty reserve tax to give it its full name is charged at 05 on the purchase but not sale of investment company shares. An OEIC is an investment company subject to corporation tax on its taxable income at the funds rate of tax which is equal to the basic rate of income tax currently 20. This relief is provided by The Land and Buildings Transaction Tax Open-ended Investment Companies Scotland Regulations 2015.

The purchase price of a fund is the net asset value plus any commission or sales charged. Income reinvestment units. The Open-ended Investment Companies Tax Regulations 1997.

The tax rules aim to put the investor in broadly the same position as if they had invested in the funds assets directly rather than through the fund. The Open-ended Investment Companies Tax Regulations 1997. OEICs are defined in Section 236 of the Financial Services and Markets Act 2000.

These Regulations make provision for the tax treatment under the Tax Acts and the Taxation of Chargeable Gains Act 1992 c. Tax within the fund. 05 October 2021 The taxation of unit trusts and OEICS - in a table A summary of the three types of units in a unit trust or shares in an OEIC.

TAXATION OF REGULATED INVESTMENT COMPANIES. CG41562 - Open-ended investment companies OEICs. An open-ended investment company or investment company with variable capital is a type of open-ended collective investment formed as a corporation under the Open-Ended Investment Company Regulations 2001 in the United Kingdom.

Stamp duty does not apply to shares in non-UK investment companies or to shares quoted on AIMIt is charged only when shares are bought on the secondary market. 60 which are incorporated in the United Kingdom. The terms OEIC and ICVC are used interchangeably with different investment managers favouring one over the other.

If the special regime applies investment vehicles are taxed at 1 corporate income tax rate. Open-end investments such as mutual funds do not pay taxes on their own but also pass on the tax burden to their investors. Mutual funds legally known as open-end companies.

12 the 1992 Act of open-ended investment companies within the meaning of the Financial Services Act 1986 c. Interest and rental income are subject to corporation tax at 20. A money market mutual fund is a no-load open-end investment company registered under the Federal Investment Company Act of 1940 which attempts to maintain a constant net asset value per share and holds itself out to be a money market fund.

12 the 1992 Act of open-ended investment companies within the meaning of the Financial Services Act 1986 c. These Regulations make provision for the tax treatment under the Tax Acts and the Taxation of Chargeable Gains Act 1992 c. An open-ended investment company OEIC is a body corporate which.

The performance of the investment company will be based on but it wont be identical to the performance of the securities and other assets that the investment company owns. OEICs offer a professionally managed portfolio of pooled. If the special regime for investment funds does not apply open-ended funds regulated under Law 352003 are subject to the general corporate income tax regime.

This instrument was made in exercise of the powers conferred by section 46 of the LBTTS Act 2013. Paragraph 2 of Schedule 19 A land transaction where a property that is subject to the trusts of an authorised unit trust is transferred to an open-ended investment company may be relieved from tax if the necessary conditions are met. City income tax under section 612 of the Tax Law and section 11-1712 of the New York City Administrative Code respectively.

Unit trusts and open-ended investment companies. This module should take around 30 minutes to complete. A taxpayer may not elect to treat part of its cash as investment capital and part as business capital.

This means that the funds capitalization is not fixed and changes upon the demand of shareholders. An open ended investment company OEIC is a type of fund sold in the United Kingdom similar to an open ended mutual fund in the US. OEICs Open Ended Investment Companies and unit trusts are commonly used collective investments and share the same tax treatment.

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

/london_stock_exchange-113017429-d2af52b2c72b427e8043a62cb5e01778-0b36a05ede834f7b84942c9b1b2c8bee.jpg)

Open Ended Investment Company Oeic Definition

What Are Open Ended Mutual Funds Who Should Invest In It

Tax Efficient Investing In Gold

4 Types Of Business Structures And Their Tax Implications Netsuite

/london_stock_exchange-113017429-d2af52b2c72b427e8043a62cb5e01778-0b36a05ede834f7b84942c9b1b2c8bee.jpg)

Open Ended Investment Company Oeic Definition

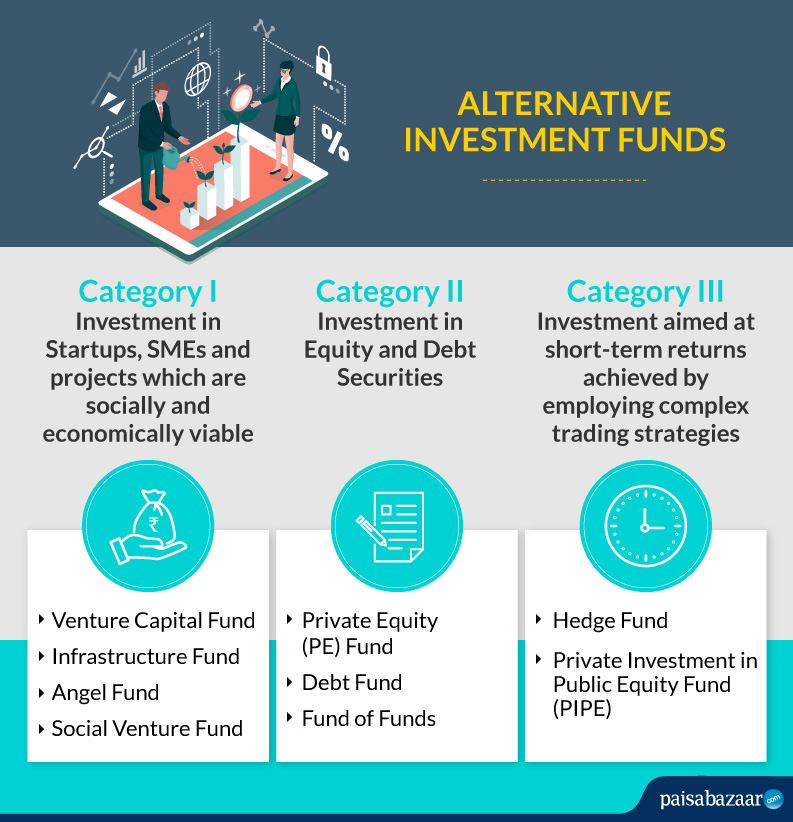

Alternative Investment Fund Know Types Taxation Rules List Of Best Aif

What Are Open Ended Mutual Funds Who Should Invest In It

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

How Do Mutual Fund Distributions And Taxes Work

Understanding Taxes And Your Investments

2019 Ontario Budget Chapter 1d

Tax Efficient Investing In Gold

Tax Efficient Investing In Gold

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

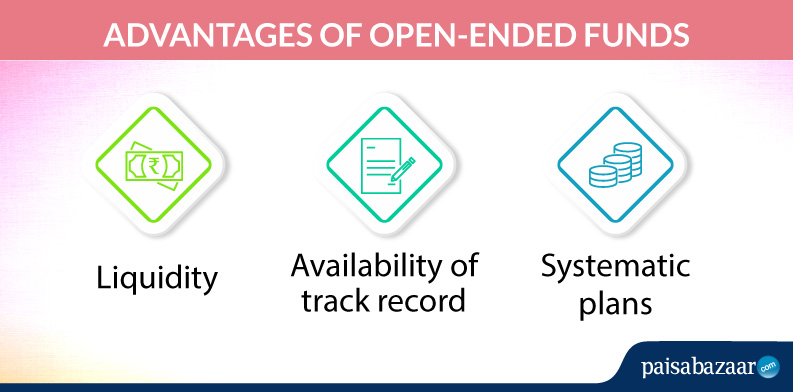

What Are Open Ended Funds Meaning Difference Advantage Disadvantage